Donor Story: Sharon & Richard

There is a saying “put your money where your mouth is”, that is exactly what staff member Richard Spackman has done by starting the Financial Literacy Fund with wife Sharon.

“In presentations I ask people what they would give to. I would always say for me it would be financial literacy. It got to the point that I needed to just get on with it, fortunately my wife agreed.” – Richard Spackman, Donor

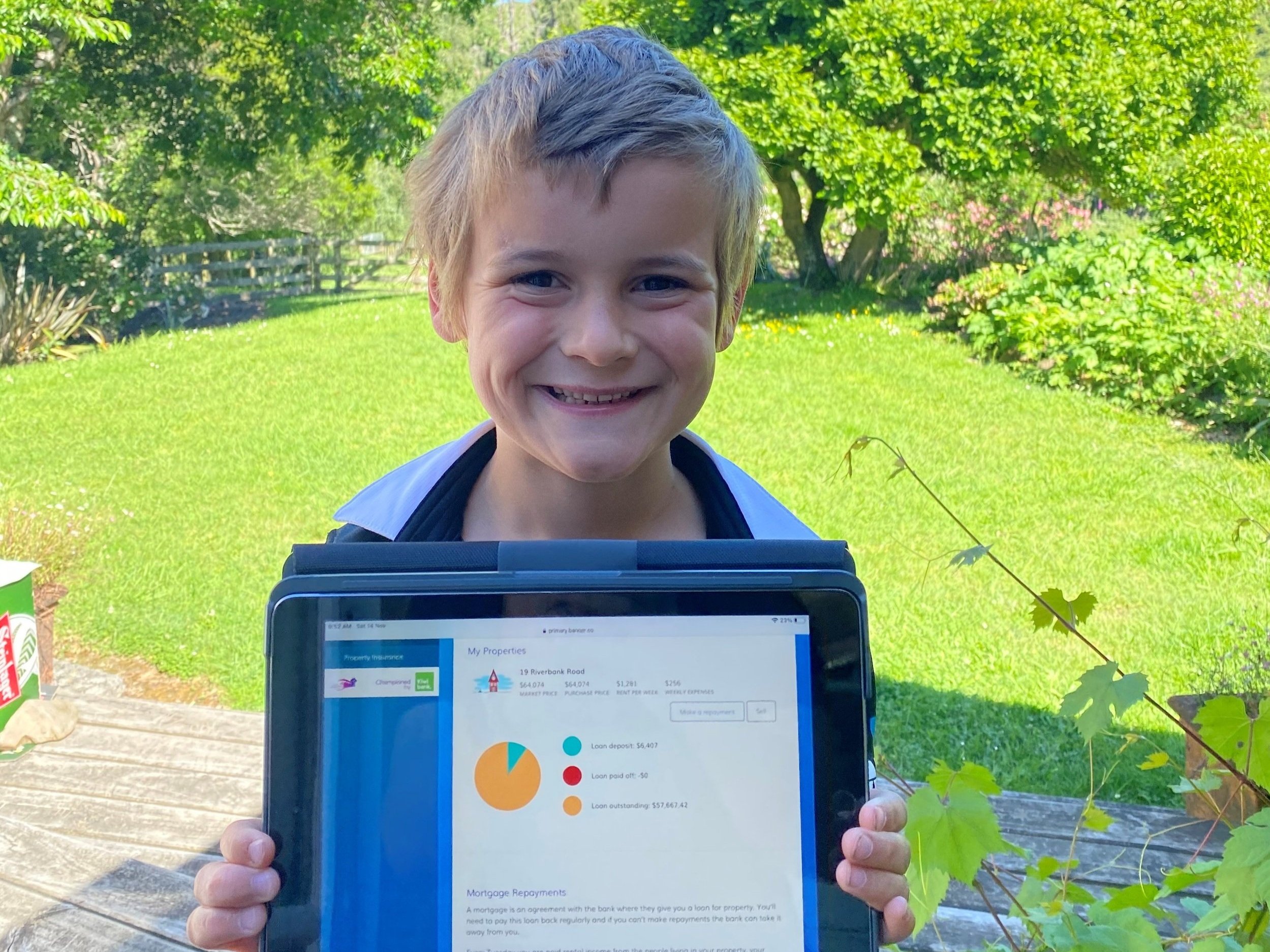

Sharon and Richard travelled with their children around New Zealand for 14 months. As part of homeschooling they took the opportunity to teach primary aged Harry & Sienna about money. They used the Banqer platform to keep them engaged with their learning. It soon became the highlight of the school day for both children and parents. Harry and Sienna learnt about all ‘things money’ and even purchased their first homes (on Banqer of course).

"It was really fun doing Banqer on the iPad. It didn’t feel like school and I learned so much about money. When I grow up I want to run a big business like Amazon or Tesla.'' – Harry Spackman, 8yrs

It wasn’t until they returned home that Sharon and Richard realised how much their children had absorbed. As Richard describes, “One day I overheard our kids discussing what they would do if they won lotto. Harry said he would buy a business to make more money whereas Sienna said she would rather invest in property.”

Financial literacy is an essential skill for everyone to make informed decisions about money and understand how to manage it effectively. The money habits we learn when young, both good and bad, will likely stick with us through adulthood. That is why it is so important for tamariki and rangatahi to have a solid financial component to their education.

Research shows that low-income families have less access to financial education which can perpetuate the cycle of poverty and financial insecurity. To break this cycle we need to take a whole of community approach to improving financial literacy. Just imagine if increasing our community’s overall financial literacy could result in dramatic positive effects like a reduction in crime, violence and social issues. Sharon & Richard believe it can, and they are looking for others to help in this mission to make a better South Canterbury for all.